Gujarat Electronics Policy 2022-2028

India is speeding up its efforts to become a global electronics manufacturing hub, with Gujarat leading the way with its forward-thinking Electronics Policy 2022-28.. This policy aims to position Gujarat as a preferred destination for Electronics System Design and Manufacturing (ESDM) by offering robust financial support, plug-and-play infrastructure, and skill development programs.

If you’re a startup, investor, or company looking to set up or expand your electronics manufacturing base, this policy offers a golden opportunity.

In this blog, we break down the key features, incentives, eligibility, and application process of the Gujarat Electronics Policy, and how Cretum Advisory can assist you at every step.

What is Gujarat Electronics Policy 2022-2028?

The goal of the Gujarat Electronics Policy 2022–2028 is to provide over 10 lakh jobs in the ESDM industry and draw in ₹1.5 lakh crore in investments.

Vision:

To make Gujarat a global electronics manufacturing and innovation hub by strengthening the state’s presence in:

- Consumer electronics

- Semiconductors and chip design

- IoT and AI devices

- Electronic components and sub-assemblies

- Telecom, automotive, medical electronics, and more

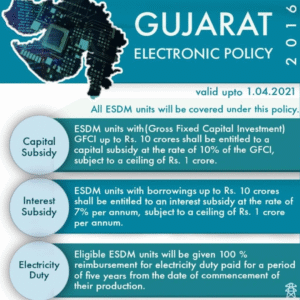

Key Incentives under the Policy

1. Capital Subsidy (Up to ₹200 Cr)

• 20% capital subsidy on fixed capital investment (plant, machinery, and equipment)

• An additional 25% for MSMEs

2. Interest Subsidy

• 7% annual interest subsidy on term loans for 5 years

• Capped at ₹10 crore per year

3. Land & Stamp Duty Concessions

• 75% reimbursement of stamp duty

• Land available at concessional rates in designated electronics manufacturing clusters (EMCs)

4. Power Tariff & Duty Benefits

• ₹2 per unit power tariff subsidy for 5 years

• 100% electricity duty exemption for 5 years

5. R&D and Skill Support

• 25% capital support for setting up R&D labs

• ₹10,000 per employee for skill training

6. Logistics Support

• 50% off export freight and logistics expenses

• Applicable for both air and sea transport

Focus Sectors & Priority Areas

The policy promotes:

- Greenfield and brownfield ESDM projects

- Fabs, chip design, ATMP units (Assembly, Testing, Marking, and Packaging)

- Component manufacturing

- Export-oriented units (EOUs)

- Startups working on electronics innovation, smart devices, and AIOT solutions

Target Zones: Where to Set Up Your Electronics Unit?

The Gujarat government has developed dedicated Electronics Manufacturing Clusters (EMCs) in areas like:

- Gandhinagar

- Dholera SIR

- Sanand

- Mandal Becharaji

- GIDC estates

These locations offer ready-to-use land, high-capacity power, common facilities, and fast-track approvals.

Eligibility Criteria

To qualify under this policy:

- The unit must be in the ESDM sector

- Must be set up in Gujarat between 2022–2028

- Capital investment must exceed ₹5 crore (₹1 crore for startups/MSMEs)

- New and expansion projects are both eligible

Application & Approval Process

- Prepare Detailed Project Report (DPR)

- Register your unit in Gujarat (Udyog Aadhaar/GSTIN etc.)

- Submit application on the state portal or through the District Industries Centre (DIC)

- Receive Letter of Intent (LOI) after evaluation

- Commence the project and submit investment proof for claim release

Challenges Faced by Businesses

- Understanding complex eligibility clauses

- DPR & documentation gaps

- Tracking subsidy disbursements

- Managing post-approval compliance (e.g., employment proof, asset tracking)

- Absence of expert advice on capital structuring, cluster selection, etc.

How Cretum Advisory Can Help You Succeed?

We help you unlock maximum benefits under Gujarat’s Electronics Policy by offering end-to-end support—from strategy to subsidy.

Our Core Services for ESDM Projects:

• Policy Advisory & Eligibility Assessment

➤ Understand which incentives apply to your business

• Detailed Project Report (DPR) Preparation

➤ Bankable & subsidy-compliant DPRs tailored to the electronics sector

• Incorporation & Legal Setup

➤ Company registration, GST, UDYAM, IEC, licenses

• Subsidy Application & Claim Filing

➤ Online portal handling, documentation, and follow-ups with DIC

• Startup & Investment Advisory

➤ Capital structuring, investor pitch decks, incentives strategy

• Virtual CFO, Tax & Compliance

➤ Monthly accounts, GST filing services, subsidy accounting, audit preparation

• Factory Setup & Cluster Consultation

➤ Land identification, industrial approvals, and electricity registration

Whether you’re setting up an electronics startup, factory, or expanding existing operations, we simplify the entire policy benefit process.

The Final Thought

The Gujarat Electronics Policy 2022-28 is a bold step toward building a robust ESDM ecosystem in India. With capital subsidies, tariff reliefs, and infrastructure support, Gujarat offers an unmatched opportunity for electronics manufacturers, startups, and global investors.

Whether you’re a tech founder, manufacturer, or investor, timing and compliance are key. At Cretum Advisory, we make sure you take full advantage of this chance by expeditiously and precisely navigating the policy, documentation, and implementation.

Frequently Asked Questions (FAQs)

Q1. Can I apply if I’m already operating in Gujarat but want to expand?

Yes. Expansion projects with fresh investment are eligible.

Q2. Do I need to be in an EMC to apply?

Not mandatory, but EMC units get additional facilitation and faster approvals.

Q3. What kind of electronics businesses are eligible?

Manufacturers of electronics goods, components, semiconductors, IoT devices, and related R&D startups.

Q4. What if I am a startup with limited funding?

You can still apply under MSME-specific benefits. Cretum can help investors with compliance and pitch decks.

Q5. How long does the approval process take?

With the right documentation and follow-ups, initial LOI approvals typically take 4–6 weeks.