The progressive Karnataka Electric Vehicle Policy aims to promote clean mobility, infrastructure development, and EV adoption throughout the state. Practically speaking, a combination of ecosystem incentives, regulatory assistance, and subsidies would speed up Karnataka’s green transformation and draw in investment. This article dissects the policy, puts the facts and figures into perspective, reveals challenges, and demonstrates how Cretum Advisory can assist you in navigating, implementing, and leveraging this regime.

Background & Evolution of Karnataka Electric Vehicle Policy

Karnataka initially introduced its Electric Vehicle & Energy Storage Policy (2017).

Amendments were made in June 2021 to ramp up incentives, particularly for charging infrastructure, manufacturing footprint, and incentive for demand.

Recently, in 2025, the state implemented a Karnataka Clean Mobility Policy 2025 to keep pace with changing EV targets and climate agenda.

So you see: the policy has evolved over time. The 2025 version is based on what was learned and new incentives added.

Key Objectives & Targets

The following are the policy’s key objectives:

• Draw in ₹31,000 crore in investment and create about 55,000 jobs in the manufacturing, battery, component, and auxiliary industries.

• By 2030, all cars, taxi fleets, business vehicles, and school vans must be fully electrified.

• Establish an EV & Energy Storage Manufacturing Cluster (grant of ₹10 crore reserved).

• Install 1,000+ EV buses in state transport corporations (BMTC, KSRTC, etc.).

• Grow charging infrastructure and battery swap systems throughout the state.

Incentives, Benefits & Policy Measures

To create both demand and supply side traction, the Karnataka policy has:

Demand-side incentives / consumer benefits

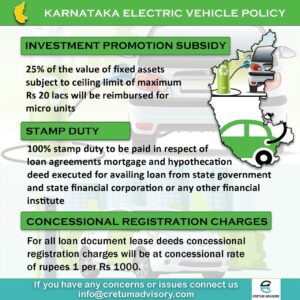

• Reduced registration fee / concessional registration for EVs.

• Waiver or exemption of stamp duty, land conversion charges, etc.

• Concession on electricity tariff for EV charging activities.

• Incentives for electric fleets adoption by public transport / bus operators.

Supply-side / infrastructure incentives

• Subsidy on capital to establish EV manufacturing, battery units, component units.

• Grants or support for establishing charging stations and battery swapping facilities.

• Industrial land support / long lease of land for EV parks.

• Exemptions on electricity duty for proposed EV operations.

• Incentives for the adoption of electric fleets by bus and public transportation providers.

The primary objectives of the plan are to de-risk capital investment, reduce entry barriers, and entice private enterprises to participate in EV manufacturing and infrastructure.

Facts and Statistics

Here’s what is happening so far — what’s working and where gaps exist:

• India’s leader in EV charging stations — ~5,765 public EV charging stations in the state, with Bengaluru

Urban city having ~4,462 stations.

• In Bengaluru, electric vehicles include about 85% two-wheelers, 5% three-wheelers, and 6% cars or taxis. Compared to 1.4 lakh in FY 2024, Karnataka registered 1.3 lakh electric two-wheelers during FY 2024–2025.

• 12,191 electric vehicles were registered during that time, up from 10,299 previously.

The In the state’s push to electrify transportation, there were 731 e-bus registrations, up from just two in 2020–21.

The main challenges include infrastructure flaws, delayed home charging, and a dearth of fast-charging stations in the hinterlands.

What it means: the policy generated momentum, particularly in Bengaluru and the charging infrastructure.

What it means: the policy created impetus, especially in the charging infrastructure and Bengaluru. However, expansion through two-wheelers and adoption outside of cities require both more robust infrastructure and tailored incentives.

Challenges & Risks

No policy is ideal. Certain specific challenges:

1.Non-metro regions’ infrastructure deficiency — fast chargers, grid preparedness, connector standardization.

2.Upfront costs high & battery reliance — most EV models are still unaffordable for mass use.

3.Incentive wear-off — subsidies could gradually be reduced or decoupled from demand over time.

4.Regulatory certainty — tax treatment disputes, electricity tariff, land use, local authorization.

5.Consumer perception / behavioral stickiness — Anxiety around range, resale value apprehensions, charging dependability.

6.Inter-agency coordination — Transportation, power, city urban bodies, policy implementation.

At Cretum Advisory, we de-mystify the intricacies of policies such as the Karnataka EV Policy and keep your business in compliance while extracting maximum benefits. Our key services that create value in the EV space are:

• Startup Consulting – Outlining your EV startup, setting up the entity, registrations, and compliance plan.

• Accounting & Advisory: Full bookkeeping, financial accounting services, management information system, and consulting for electric vehicle enterprises.

• GST and Indirect Tax: GST registration, submitting returns, handling refunds, and adhering to EV sector incentives

• Income Tax & Direct Tax – Tax planning, assessments, and corporate tax compliance.

• CFO Services – Virtual CFO services for budgeting, forecasting, financial modeling, and investor readiness.

• M&A & Transaction Advisory – Structuring of deals, valuations, and due diligence for EV investments and partnerships.

• Secretarial & Company Law – Company Act compliance, ROC filings, board/shareholder resolutions.

• Customs & International Trade – Advisory on imports of EV, structure of duties, exemptions, cross-border compliance.

In brief: We fill the gap between government policy and business implementation — your EV project or business enjoys each incentive without compliance worries.

Services We Offer (at Cretum Advisory)

• EV / Clean Mobility Consulting

• Scheme & Incentive Advisory

• Regulatory & Compliance Support

• Transaction Advisory & Financial Modeling

• Indirect Tax Advisory & Tax Structuring

• Grid Assessment & Infrastructure Feasibility

• Due Diligence & Investment Assistance

• Monitoring & Performance Measurement

So whether you’re scaling a fleet, creating charging stations, planning an EV manufacturing unit, or raising capital — we have end-to-end support.

The Final Thought

The Karnataka Electric Vehicle Policy is perhaps the most progressive state-level EV structure in India. It reconciles demand incentives, supply-side incentives, infrastructure push, and regulatory support. But policy is not enough. You require a collaborator who can assist you in converting the incentives into on-the-ground deployment — from site selection to compliance, from financial modeling to delivery.

That’s where Cretum Advisory steps in. We don’t only advise — we are your execution partner in the EV sector in Karnataka.

Next step: Chat with us. We can talk about your project idea, create your financial model, map out your incentives, and guide you through each stage. Let’s start by exchanging emails or messages.

Frequently Asked Questions, or FAQs

Q1 Which car models are covered by the Karnataka EV policy, to start?

A: Private and fleet vehicles, e-buses, two- and three-wheelers, and support equipment (batteries, chargers) are all covered by the policy.

Q2: Is there funding available to install charging stations?

A: Yes — the policy provides capital support or grants for installing charging / battery swap infrastructure under specified conditions.

Q3: Are there tax or land benefits for EV makers in Karnataka?

A: Yes — incentives are concessional land lease, exemption/waiver of stamp duty, electricity duty exemptions, and plant setup capital subsidy.

Q4: What does the state provide in support of public transport electrification?

A: The policy requires/exhorts EV bus deployment through BMTC, KSRTC, etc. It also provides incentives to operators for electric bus purchases.

Q5: Should my project fail, would incentives be revoked?

A: Usually, incentives are determined by milestones, performance, and compliance. You will lose access to some incentives if you don’t reach targets or break agreement

Q6: For how long is the policy valid / review process?

A: The policy tends to be effective until revised.Karnataka has already modified the 2017 policy in 2021 and introduced the Clean Mobility Policy 2025.

Q7: Can a non-Karnataka company gain benefits?

A: Exclusive for projects or investment within Karnataka. Off-site firms can establish manufacturing or infrastructure within the state to avail of incentives.