Madhya Pradesh BPO/BPM Policy: Objectives, Incentives & Key Benefits

Madhya Pradesh (MP) has become a thriving center for the business process management (BPM) and business process outsourcing (BPO) industries. The goal of the state’s comprehensive policy framework is to encourage growth, draw in capital, and generate employment. The following article discusses the aims, incentives, and main advantages of the MP BPO/BPM Policy, as well as how Cretum Advisory can help companies navigate this.

Objectives of the Madhya Pradesh BPO/BPM Policy

The MP BPO/BPM Policy is aimed at:

Employment Generation: Generate jobs for local youth.

How Cretum Advisory Helps:

With Startup Consulting Services, Accounting & Advisory Services, we assist in creating operations and staffing to meet local employment requirements while ensuring fiscal viability.

Infrastructure Development:

Establish IT-enabled infrastructure to enable operations.How Cretum Advisory Assists: Our Secretarial/Company’s Act services help with legal approvals, land allotment documents, and setup compliance for IT parks or leased premises.

Attract Investments:

How Cretum Advisory Assists: With the aid of M&A/Transaction Advisory and CFO Services, we frame the investment model for optimal subsidy eligibility and financial effectiveness. We facilitate coordination with training partners and process reimbursement claims through Accounting & Advisory and GST Services for skill development programs that qualify.

Regional Development:

Facilitate equitable growth of cities and towns.

Our CFO Services and Startup Consulting lead businesses to high-incentive locations for quick approvals and cost savings.

Key Incentives Under the Policy

MP BPO/BPM Policy provides a variety of incentives to entice and provide support to businesses:

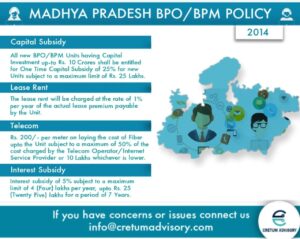

1. Capital Investment Subsidy

Eligibility: New BPO/BPM units with capital investment of up to ₹10 Crore.

Benefit: One-time 25% of the investment capital subsidy, up to a maximum of ₹25 Lakhs.

2. Interest Subsidy

Eligibility: Units with capital investment of up to ₹10 Crore.

Benefit: 5% interest subsidy per annum, up to ₹25 Lakhs annually, for 7 years.

3. Rent Subsidy

Eligibility: Units that rent buildings for their operations.

Benefit: Subsidy of ₹11 per sq. ft. per month, up to a limit of ₹40 Lakhs in 5 years.

4. Telecom Connectivity Subsidy

Eligibility: Units that need fiber optic connections.

Benefit: Subsidy of ₹200 per meter for laying fiber, subject to a limit of ₹10 Lakhs.

5. Reimbursement for Developing Skills

Eligibility: Local Skill Training Units.

Benefit: 50% reimbursement of training expense, up to ₹10,000 per employee, in the initial two years of business.

6. Statutory Exclusions

Provisions: Subject to providing safety rules, the Madhya Pradesh Shops and Establishment Act of 1958 exempts flexible work schedules and 24-hour workdays.

Principal Advantages for Companies

- Cost Savings: Subsidies that are attractive cut operational and setup expenses.

- Skilled Manpower: Access to trained and skilled local manpower.

- Industry Support: Easy procedures and legal exemptions enable seamless operations.

- Infrastructure Support: Presence of established IT parks and connectivity infrastructure.

- Government Support: State organizations actively offer government support and facilitation.

Important Takeaways

Up to ₹25 lakhs, or 25% of the investment, is covered by the capital subsidy.

Interest subsidy: up to ₹25 lakhs for seven years at a rate of 5% yearly.

Rent Subsidy: ₹11/sq. ft., up to ₹40 Lakhs over 5 years.

Telecom Subsidy: ₹200/meter for laying of fibers, maximum ₹10 Lakhs.

Skill Reimbursement: 50% of the training expenditure, a maximum of ₹10,000/employee.

FAQs

Q1: Eligible to get the incentives under MP BPO/BPM Policy is whom?

A1: New BPM/BPO units of capital investment not exceeding ₹10 Crore and those satisfying employment and infrastructure requirements are eligible.

Q2: How do I get these incentives?

A2: Forms can be applied to the Madhya Pradesh State Electronics Development Corporation (MPSEDC) with proper documents.

Q3: Is there any ongoing support program?

A3: Yes, support is provided continuously by the state through training programs, infrastructure creation, and policy revisions.

Q4: Are these incentives available for existing units as well?

A4: The incentives are mainly for new units. Existing units can look into specific schemes under the Industrial Promotion Policy.

Q5: How long are these incentives offered?

A5: The timeframe differs for each incentive. For example, interest subsidies last for as much as 7 years.

How Cretum Advisory Can Help?

We, at Cretum Advisory, are experts in navigating businesses through the intricacies of the MP BPO/BPM Policy. Our services are:

Policy Interpretation: Facilitating companies in comprehending and navigating the policy structure.

Help with Applications: Offering support in creating and filing incentive applications.

Supporting adherence to deadlines and regulatory requirements is known as compliance assistance.

Giving advice on the most effective operational and investment strategies is known as strategic guidance.

Training Coordination: Arranging skill development programs in association with training partners.

Partnering with Cretum Advisory guarantees that businesses are able to enjoy the maximum benefits of the MP BPO/BPM Policy, resulting in successful establishment and development in Madhya Pradesh.